The real estate market locally and nationally has rebounded and it feels like it is 2006 all over again.

The lack of inventory in many westside communities along with historically low interest rates and high demand from buyers has changed the market dynamics significantly compared to a year ago.

Bankrate.com listed the average interest rate nationally at 3.67% on Feb. 15 for a 30 year fixed loan.

The Federal Reserve Bank said that it plans on keeping interest rates low until the unemployment rate hits 6.5% but we will see if that holds true.

Buyers are currently faced with multiple offer situations on almost every new home or condo that comes on the market and prices are being pushed upward of 10% over the list price.

There are lots of buyers that are paying “all cash” which is beating out those buyers that are getting loans.

It has made for an extremely tough process for buyers but has put sellers in the driver’s seat.

With the recovering market appraisals continue to be a problem. Lots of properties that are selling for over the list price are having problems getting the appraisal to come in at the agreed to purchase price.

This is not necessarily because of the lack of comparable sales but can be due to the appraiser not knowing the area and/or not having an understanding of the current market.

Historically springtime is when inventory starts to pick up so there is reason for buyers to stay optimistic.

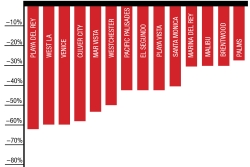

According to Clarus Market Statistics comparing Active listings in January 2012 versus 2013 the areas with the sharpest declines in inventory are Playa del Rey (-62%), West Los Angeles (-60%), Venice (-60%) and Culver City(-58%). The areas that have seen the least decline in inventory are Palms (-27%), Brentwood (-30%), Malibu (-30%) and Marina Del Rey (-31%).

These sharp declines in inventory has led to the Median Price in all the areas listed in the chart having increased by 20% compared to the same period a year ago.